Introduction: Your Journey to Smarter Trading Begins Here

Hello and welcome to the most exciting part of your trading adventure. Imagine having a powerful window into the financial markets that you can shape and customize exactly the way you want. A window that shows you exactly what you need to see, when you need to see it, and in a format that makes perfect sense to you. This is exactly what MetaTrader 4 offers, and when you pair it with the right CFD broker CFD broker with flexible mt4 charting tools , your trading possibilities become truly limitless.

Finding a CFD broker with flexible MT4 charting tools is like discovering the perfect partner for your trading journey. The charts you use are your eyes on the market, revealing price patterns, trends, and opportunities that might otherwise remain hidden. Having the freedom to adjust these charts, add the indicators that matter to you, and arrange everything in a way that feels natural and comfortable can transform your entire trading experience.

In this friendly and comprehensive guide, we will walk through everything you need to know about choosing a broker that offers exceptional MT4 charting flexibility. We will explore the wonderful features that make MT4 so beloved by traders worldwide, the special enhancements that top brokers provide, and how you can create the perfect charting setup for your unique trading style. Whether you are just beginning your trading journey or looking to upgrade your current tools, this guide will light your path forward.

Why MetaTrader 4 Remains the Trader’s First Choice

Before we explore specific brokers, let us take a moment to understand why MetaTrader 4 has captured the hearts of millions of traders around the world and why it continues to be the platform of choice in 2026.

A Platform That Stands the Test of time

MT4 has been around for many years, and its longevity is a testament to its quality. The platform was built with a deep understanding of what traders actually need. It is stable, reliable, and performs beautifully even during times of high market volatility when every second counts.

The interface is thoughtfully designed, putting essential tools within easy reach while keeping advanced features accessible when you need them. This balance makes MT4 welcoming for beginners while offering the depth that experienced traders demand.

Complete Freedom to make It Your own

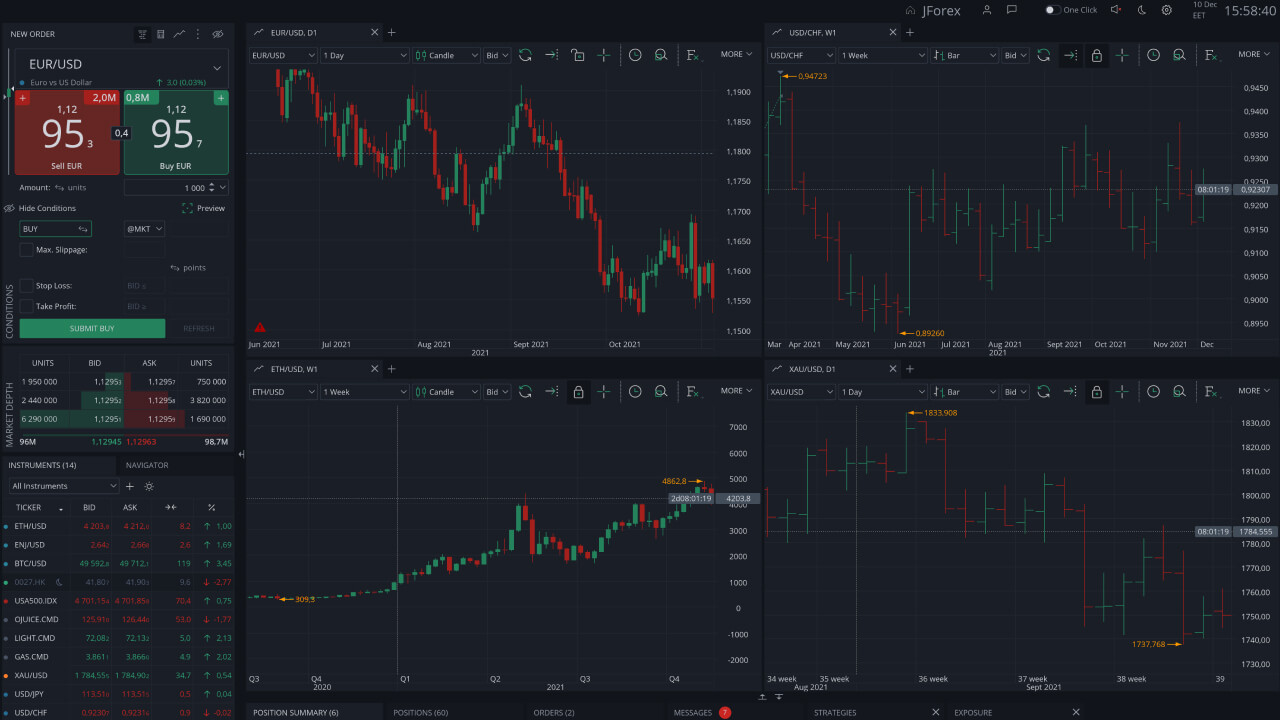

One of the most wonderful aspects of MT4 is how much control you have over your trading environment. You can open multiple charts, arrange them in any configuration that suits your workflow, and save these arrangements as profiles that you can switch between instantly.

Colors, fonts, and visual elements are all adjustable. Some traders prefer dark themes that reduce eye strain during long analysis sessions, while others like light backgrounds for better contrast. MT4 lets you choose what works best for you, creating a comfortable space where you can focus entirely on your analysis.

A Treasure Trove of Analytical Tools

At its heart, MT4 is a technical analysis powerhouse. The platform comes with thirty built-in technical indicators that cover all the major categories of market analysis. You have trend indicators to help you follow market direction, oscillators to identify overbought and oversold conditions, and volume indicators to understand the strength behind price movements.

Beyond these built-in tools, MT4 supports thousands of custom indicators created by the global trading community. This means you are never limited to just what comes with the platform. If you can imagine an indicator, chances are someone has already created it and made it available for download.

Understanding Flexible Charting Tools and Their Magic

Now let us dive deeper into what we mean by flexible charting tools and why they are so essential for your trading success. Flexibility in charting means having the freedom to view and analyze market data in ways that match your personal approach to trading.

Seeing the full Picture with Multiple Timeframes

Smart traders know that no single timeframe tells the complete story. The daily chart shows you the major trend, the four-hour chart reveals the medium-term movement, and the fifteen-minute chart helps you fine-tune your entry timing.

Flexible charting tools let you have all these timeframes visible at once, arranged on your screen in a way that makes sense to you. This multi-timeframe analysis gives you context that single-chart traders miss, helping you make more informed decisions about when to enter and exit your trades.

Combining Indicators for Stronger Signals

Every indicator has its strengths and weaknesses. Moving averages are great for identifying trends but can be slow to react to sudden changes. Oscillators catch turning points early but can give false signals in strong trends.

By combining different types of indicators on your charts, you can create a more complete picture of market conditions. Flexible charting tools make it easy to layer indicators, adjust their parameters, and see how they interact in real-time. This helps you filter out noise and focus on the highest-probability setups.

Drawing Your way to better Analysis

Technical analysis is partly an art, and drawing tools are your brushes. Trendlines connect important highs and lows, showing you the direction of the market. Support and resistance levels mark price zones where the market has historically turned. Fibonacci tools reveal potential reversal levels based on mathematical relationships.

MT4 provides a comprehensive set of drawing tools that you can apply directly to your charts. These drawings can be saved with your chart templates, so you do not have to redraw them every time you open a new chart. This continuity helps you track how price interacts with important levels over time, building your understanding of market behavior.

How Brokers Enhance MT4 with Additional Charting Flexibility

The really exciting news is that many wonderful brokers go above and beyond the standard MT4 offering, providing their clients with enhanced tools and features that take charting flexibility to entirely new levels.

Premium Indicator Collections

Some brokers offer their own collections of premium indicators that are not available to the general public. These indicators are often developed by professional traders and quantitative analysts, giving you access to sophisticated analysis tools that can provide a genuine edge in the markets.

These premium packages might include unique oscillators that identify divergences more reliably, custom moving averages with intelligent calculation methods, or volatility measures that help you adapt to changing market conditions. Having access to tools that other traders do not have can help you see opportunities that might otherwise go unnoticed.

Advanced Pattern Recognition

Imagine having a tool that continuously scans your charts, alerting you whenever it detects a classic chart pattern. Automatic pattern recognition does exactly this, saving you hours of manual chart analysis and ensuring you never miss an important setup.

These tools can identify patterns like head and shoulders, double tops and bottoms, triangles, flags, and wedges across multiple timeframes. They can also highlight Fibonacci patterns and harmonic formations, giving you even more reasons to pay attention to specific price levels.

Integrated Risk Management Tools

Smart charting is only half the battle. You also need effective tools for managing your risk and executing your trades. Many brokers integrate risk management calculators and trade management features directly into their MT4 platforms.

These tools help you determine appropriate position sizes based on your account balance and the distance to your stop loss. They can also assist with setting profit targets based on chart patterns, ensuring your trades are properly protected from the moment you enter them.

Top CFD Brokers Offering Exceptional MT4 Charting Flexibility in 2026

Now let us explore some of the wonderful brokers that provide outstanding MT4 charting experiences. Each of these brokers has earned a reputation for supporting traders with excellent tools and reliable service.

IC Markets: The ultimate Choice for Platform Flexibility

IC Markets has established itself as a true leader in the CFD brokerage space, and their MT4 offering is genuinely exceptional. Regulated by top-tier authorities including ASIC and CySEC, IC Markets provides a secure and transparent trading environment that traders can trust completely.

**Outstanding Charting Features: **

IC Markets offers the full MT4 platform with all its standard capabilities, plus integration with some of the most powerful analysis tools available. Their clients can access the complete range of MT4 indicators and drawing tools while benefiting from the broker’s ultra-fast execution speeds.

**Trading Instruments: **

With over 2, 250 trading instruments available, you have endless opportunities to apply your charting skills across forex, commodities, indices, stocks, and cryptocurrencies. This incredible variety lets you diversify your analysis and find the best setups regardless of market conditions.

**Account Options: **

IC Markets provides both Standard and Raw Spread accounts, giving you flexibility in how you manage your trading costs. The Raw Spread account offers spreads from 0. 0 pips with a small commission, which is ideal for active traders who want the tightest possible pricing.

Pepperstone: Award-Winning Platform Excellence

Pepperstone has won numerous awards for their trading platforms, and their MT4 offering demonstrates why they are so highly regarded. The broker combines the power of MT4 with their own Smart Trader tools, creating a truly comprehensive trading environment.

**Smart Trader Tools: **

These additional tools include sentiment indicators that show you how other traders are positioned, correlation matrices that help you understand relationships between different instruments, and advanced trade management features that streamline your entire workflow.

**Exceptional Execution: **

Pepperstone is known for lightning-fast execution speeds, with the majority of trades executed in under 30 milliseconds. This incredible speed is crucial when you are trading based on chart patterns and technical signals that require precise entry and exit timing.

**Regulatory Protection: **

Regulated by top authorities including the FCA and ASIC, Pepperstone provides the peace of mind that comes with strong client protections and segregated accounts.

OANDA: Premium MT4 with Advanced Enhancements

OANDA has been a trusted name in online trading for over 25 years, and their MT4 offering reflects this deep experience. The broker provides a premium MT4 upgrade that adds significant functionality to the standard platform.

**Depth of Market Information: **

One of the most valuable OANDA enhancements is access to depth of market data. This shows you the available liquidity at different price levels, helping you understand where large orders might be waiting and how price might react when it reaches those levels.

**Advanced Order Management: **

The OANDA MT4 upgrade includes sophisticated order management tools like one-cancels-the-other orders and bracket orders. These tools help you manage multiple scenarios simultaneously, protecting your profits and limiting your losses automatically.

**Trust and Transparency: **

As a founding member of the FCA’s enhanced regulatory framework, OANDA demonstrates an ongoing commitment to transparency and client protection.

Tickmill: Comprehensive Trading Toolkit

Tickmill offers an impressive Advanced Trading Toolkit that integrates seamlessly with MT4, providing everything you need for thorough market analysis in one beautiful package.

**Figaro Chart Tool: **

This powerful addition gives you access to over 100 technical indicators and more than 50 drawing tools, far exceeding what is available in standard MT4. You can customize these tools extensively and save your preferred configurations for easy access.

**Sentiment Analysis: **

The Sentiment Trader feature provides real-time data on how other traders are positioned. This information can be incredibly valuable for identifying potential market reversals when sentiment becomes extremely one-sided.

**Competitive Pricing: **

Tickmill is known for low spreads and transparent pricing, with their Raw Spread account offering some of the most competitive rates in the industry.

FxPro: Multi-Platform Excellence

FxPro provides MT4 alongside their other popular platforms, giving you the flexibility to choose the environment that works best for your trading style.

**Advanced Charting Package: **

The FxPro MT4 offering includes all the standard features plus integration with some of the most popular third-party analysis tools. You can access a wide range of custom indicators and Expert Advisors, expanding your analytical capabilities significantly.

**Educational Resources: **

FxPro provides extensive educational materials to help you get the most from your charting tools. Webinars, tutorials, and written guides cover everything from basic chart reading to advanced technical analysis techniques.

**Strong Regulation: **

Regulated by the FCA, CySEC, and other respected authorities, FxPro offers the security and transparency that serious traders demand.

Essential MT4 Charting Features to maximize Your Analysis

Now that you know which brokers offer excellent MT4 charting, let us explore the specific features you should be using to get the absolute most from your market analysis.

Template Management for Efficiency

Creating and saving chart templates is one of the most time-saving features in MT4. A template saves everything about your chart setup, including which indicators are applied, their settings, the chart type and colors, and any drawings you have made.

You can create different templates for different trading strategies or market conditions. For example, you might have a trend-following template with moving averages and MACD, and a mean-reversion template with Bollinger Bands and RSI. Switching between them takes just seconds, allowing you to adapt quickly to changing market conditions.

Multi-Chart Arrangements for Comprehensive View

Do not limit yourself to a single chart. MT4 allows you to open multiple charts and arrange them in any configuration you like. You might have a main chart for your primary instrument, with smaller charts showing correlated instruments or different timeframes arranged around it.

This multi-chart view gives you a complete market picture at a single glance. You can see how related instruments are behaving, check higher timeframes for context, and monitor lower timeframes for entry precision, all without switching between windows.

Custom Indicators for Unique Perspectives

While the built-in indicators cover most needs, the custom indicator ecosystem is where MT4 truly shines. Thousands of indicators are available for free download, created by traders who wanted to solve specific analytical challenges.

Some popular custom indicators include:

- **Volume Profile: ** Shows trading activity at different price levels

- **Order Flow: ** Helps visualize buying and selling pressure

- **Market Facilitation Index: ** Combines price and volume for unique insights

- **Advanced Moving Averages: ** Variations on the classic theme with different calculation methods

Expert Advisors for Automated Analysis

Expert Advisors (EAs) are automated trading programs that can analyze charts and even execute trades based on your specified rules. While fully automated trading requires careful development and testing, EAs can also be used simply as advanced analytical tools.

You can create EAs that scan multiple instruments and timeframes, alerting you when specific conditions are met. This is like having a tireless assistant working 24 hours a day, ensuring you never miss a potential opportunity while you sleep or attend to other matters.

How to choose the perfect Broker for your MT4 Charting Needs

With so many excellent brokers available, selecting the right one for your specific needs requires careful consideration of several important factors.

Assess Your personal Trading Style

Your personal trading style should guide your broker selection. Day traders and scalpers need fast execution and tight spreads to make their strategies work effectively. Swing traders and position traders might prioritize analysis tools and educational resources over ultra-fast execution.

Think about the timeframes you typically trade and the instruments you focus on most. Make sure your chosen broker offers competitive conditions for those specific markets and provides the charting tools that match your approach.

Evaluate Regulatory Protection

Never compromise on regulation. Always choose brokers regulated by respected authorities like the FCA, ASIC, or CySEC. These regulators enforce strict rules that protect client funds and ensure fair treatment for all traders.

Check the broker’s website for clear information about their regulatory status and which entity will handle your account. If this information is difficult to find, consider it a warning sign and look elsewhere.

Test Thoroughly with Demo Accounts

Demo accounts are one of the most valuable tools for evaluating brokers. Almost every reputable broker offers free demo accounts that let you test their platforms without risking any real money.

Use the demo period to thoroughly explore the MT4 charting features. Try different indicator combinations, practice drawing and saving chart patterns, and see how the broker’s enhanced tools perform in real market conditions. This hands-on testing will tell you more than any marketing material ever could.

Consider Additional Tools and Resources

Beyond charting tools, consider what other resources the broker provides. Educational materials, market analysis, webinars, and trading guides can all help you improve your skills and get more value from your charting efforts.

Some brokers also offer community features where you can share ideas and learn from other traders. These communities can be valuable sources of inspiration and learning, especially when you are developing your trading approach.

Getting started with Your MT4 Charting Journey

Ready to begin your adventure with flexible MT4 charting? Here is a simple step-by-step guide to get you started on the right foot.

Step 1: Select Your Ideal Broker

Based on the information in this guide, choose a broker that matches your trading style and offers the charting tools you need most. Consider starting with one of the brokers we have discussed, as they have proven track records of supporting traders with excellent MT4 implementations.

Step 2: Open Your Account

Visit your chosen broker’s website and open either a demo account or a live account. The process is typically quick and straightforward, requiring only basic personal information and identification verification for live accounts.

Step 3: Download and Install MT4

Your broker will provide clear instructions for downloading and installing their version of MT4. Follow these instructions carefully to ensure you get the correct version with all their enhanced features properly integrated.

Step 4: Explore and Customize Freely

Take plenty of time to explore the platform thoroughly. Open charts for instruments you are interested in, apply different indicators, and experiment with chart settings. Save any useful configurations as templates for future use.

Step 5: Practice Your Analysis Skills

Use your demo account to practice analyzing charts and identifying trading opportunities. Keep a simple trading journal to track your analysis and see how well your chart-reading skills translate to actual market movements.

Step 6: Transition to live Trading Confidently

When you feel truly confident in your analysis abilities and completely comfortable with the platform, you can begin live trading. Start with an amount you are comfortable with and continue using the same charting techniques you practiced on the demo.

Conclusion: Your Charting Adventure Awaits

The beautiful combination of a reliable CFD broker and flexible MT4 charting tools creates a powerful foundation for your trading success. With the ability to customize your analysis environment, access advanced indicators, and use broker-enhanced tools, you have everything you need to understand market behavior and make informed trading decisions.

Remember that becoming truly proficient with charting takes time and dedicated practice. Be patient and kind with yourself as you learn, and celebrate small improvements along the way. Every great trader started exactly where you are now, learning to read charts one candle at a time.

The wonderful world of MT4 charting awaits you, filled with endless opportunities to learn, grow, and succeed. May your charts always be clear, your analysis always be sharp, and your trading journey be richly rewarding. Welcome aboard, and happy trading.